If you’re a regular reader of this newsletter, if you open it all the time, if you save it for an escape or forward it to friends and family and have conversations about it— consider becoming a paid subscribing member.

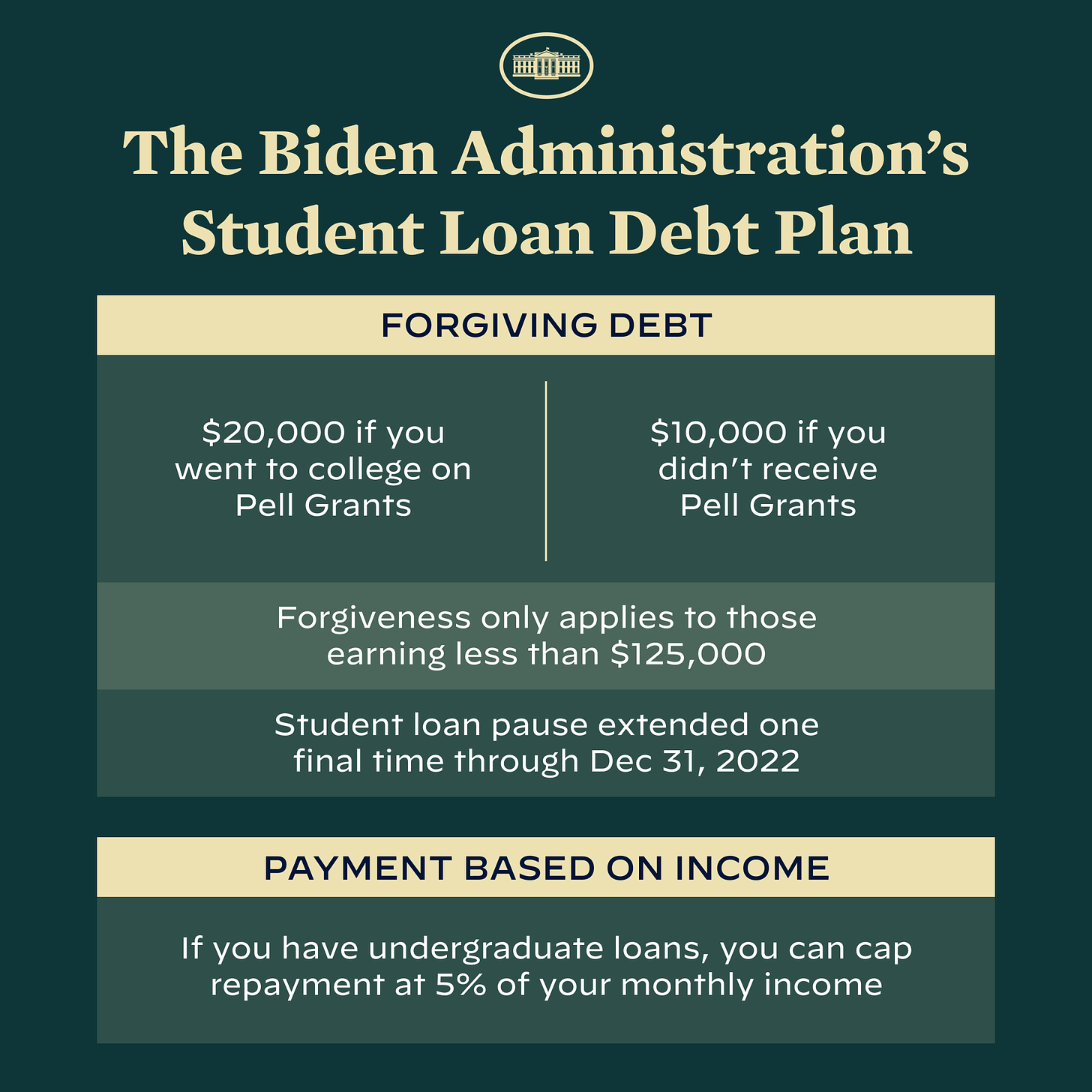

I have written so much about the need for student loan cancellation that it feels wild, just wild, that it’s actually happening. That depending on their loan type, people making under $125,000 a year (or $250,000 as a couple) are going to check their inboxes and find $10,000 (or $20,000, if they have Pell Grants) in debt gone. Lifted. The very beginning steps of a debt jubilee.

To be clear: it is not enough. For many borrowers, $10k hardly even covers the interest they’ve accrued on their balance. It’s particularly not enough for those with massive debt loads. But it’s also going to make a huge difference for the millions who started school and, for whatever reason, could not finish it — yet still carry the debt, without any of the benefits of a degree.

And while the reforms to Income-Driven Repayment on undergraduate loans are going to make repayment so much less burdensome going forward (seriously, read about them, they’re game-changers) it’s also time, as public policy professor Fenaba R. Addo points out in the Tweet below, to use this momentum to think bigger.

To think, as she and co-author Jason N. Houle do in their forthcoming book, about loan relief as racial justice — a form of reparations. To conceive of the way that loans have forced a generation of students, told that college was the only route towards stability, to mortgage their futures. To understand that so many professions, professions we deem necessary to a functioning society, have come to demand a level of credentialization that forces debt. To think about how little effect loan forgiveness would have on the governmental finances (we’ve paused loans for over two years! Somehow it’s okay!) and just how life-changing it would be for those who hold them.

And it’s time to concurrently move forward with re-funding public institutions and reimagining tuition costs — while also further regulating for-profit colleges (and graduate degrees!) so that these levels of debt aren’t reproduced for the generations to come. (And if you have counter-arguments, like “cancellation is regressive, actually” I promise they’re covered and rebutted in this truly excellent and accessible conversation between student debt experts Tressie McMillan Cottom and Louise Seamster).

Part of the way we continue to think bigger is by seeing what forgiveness does and can do. So that’s what we’re going to do here, for the rest of this post, which I’ve assembled from hundreds of responses from people with all sorts of backgrounds and situations and types of debt. People who are looking at their first chance at wealth building in the form of home ownership. People who will be able to care for others in their family falling through the safety net. People who, for the first time in their adult lives, will be able to live without financial ruin around the corner. People who are weeping because stability, and the ability to start staking a future, feels so incredibly foreign. I hope you’ll consider adding what student debt cancellation could and would do for you in the comments — even if it hasn’t happened yet.

This is the beginning of a movement of reformation and restoration following decades of predatory student debt practices. Let’s push it forward.

The student loan forgiveness announced today is HUGE for me. My parents did not make a lot of money growing up: when I last saw their tax records in 2009, it was around $42,000 combined. Aside from a small Parent Plus loan, they were not able to help with schooling expenses at all. Thus, I took out loans for everything: tuition, housing, living expenses.

By the time I graduated from a state school, I had about $20,0000 in federal debt at 6.8% interest. I graduated in the midst of the Great Recession, so the only job I could find after moving back home paid $9/hr. 13 years later, having paid roughly $16,000 and taken several hardship forbearances, I still have $15,000 remaining. Because of the Pell grant escalator, I'll be completely free of student loans once this takes effect. I can't wait.

It's going to make buying a house and having a kid with my partner much more attainable. It should free up roughly $500 a month between the two of us, allowing us to put that towards other debt and savings.

I’m in the 10k of forgiveness bucket, and because I only have undergrad government loans that cuts my total student loan debt by a third. That, coupled with my decent paying job (that has nothing to do with my expensive degree lol) means I’ll probably be able to repay within the next ten years instead of 15 or 20.

That doesn’t sound like a huge blessing, but the reason I only have these loans and not private loans is because my parents paid 5k or so each year of my tuition. Now I’ll be paid off and maybe even have some equity built up by the time they have to start worrying about end of life care, so I’ll have money to repay the favor and take care of them like they took care of me.

Both mine and my husband’s debt will be cleared due to this additional Pell Grant announcement. HUGELY life changing for two people who now both work in nonprofits and had a lot of financial hurdles getting to and through undergrad!! I’m feeling emotional and grateful and deeply, deeply believe that relief of ALL debt for all borrowers is integral to closing racial wealth gap/ensuring health of our communities/enhancing economic mobility.

Because I got Pell Grants, my student loans have now halved. I have 12k left — and now there’s forgiveness after 10 years [of payments]— means it's now likely my loans will be done in 2 years. I'm sobbing. I've been sobbing all morning. It means I can buy a house or a Condo. I can contribute more to my retirement. I feel like after so much hard work that I will finally be financially stable. I'm 42 and it'll make me feel like I hit some markers of adulthood.

It's a big fucking deal to me. My history teacher husband got fired in Jan. (he was 10 months away from PSLF) for not teaching *the right kind of history.* It's a private school, our kids were students there l, and to get them out of the school, we had to use MY student loans (I was completing my undergrad) to pay the rest of their tuition contract which was $4k.

Biden's Executive Order will forgive all of my student debt and leave us with <$10k from my husband's. For my family, an enormous financial and trauma burden is lifted today. I can't stop crying.

A 19 year old albatross on my neck, gone in an instant! I'm so happy, you have no idea! I had Pell grants but my outstanding balance is (was?) $9,293.53. Oldest loan dated 09/30/2003. No politician has ever done so much for me in my entire life! No loan payment means more fresh fruit and veg in our fridge, more books for our boys and now I can afford to get new clothes too. I'm in total disbelief!

I was a Pell recipient, and all my debt was 19k when I graduated, thanks to my college meeting full demonstrated need. I got it down to 13.5k before the [student loan] pause. I'd figured out how to get grad school paid for by working in universities. Fast forward to now, and I've taken an offer for a six-figure job that is far away and without a car, the commute is an hour or more. With one, it’s only 30 min. Without the relief I couldn't have considered a car. Additionally this will help me to help out my family which I've not been able to do the way I want to yet. I can save for a down payment. It's been a weird two weeks financially but I wept when the 20k for Pell news came though.

I want more forgiveness and will vote for it. But I have to say this limited forgiveness is a huge deal for our family. It's the final drops of loans my husband took out for a degree he never finished. It's most of the loans I took out basically to buy winter clothing and food that my Ivy League need-based aid didn't cover. I think our expectations are super low we are used to DIY everything after growing up poor. But catching small breaks like this is a huge deal to us.

Depending on how the Pell Grant thing works, it could eliminate all but $5K of my 23-year-old's debt. (He graduated in May 2022, attended community college for the first two years to save on costs). He wants to save for a car and a house - currently lives with us due to high cost of living as he begins a career in marketing (psych major who didn't want grad school loans).

It looks like I will only have 20K left on my law school loans from 1994 (yep!). I'm 54 and a writer, never practiced law. Generational privilege alert: A modest inheritance in 2020 allowed me to pay down some of my loan, so I'd be able to pay the remaining $20K in a couple of years and redirect that money toward retirement and helping my two younger kids with college.

Due to my loans and some credit card debt, we never made enough to save for our kids' education. If the cost of college went down AND we had affordable universal healthcare, so many people could pursue careers and become entrepreneurs without being saddled with debt that could otherwise go toward retirement and day to day living.

Suddenly the thought of my wife and I buying a house one day seems…possible. My wife has just about 10k left on her loans. If this goes through and doesn’t end up being struck down by some wild legal challenge, this suddenly puts it in a virtually debt free position for the first time in our relationship/marriage. It’s great news, still kind of in disbelief this is happening.

Paying a mortgage doesn’t seem so far away now. I can actually imagine owning a home!

I’m 29 with no family money, I’m single and entirely dependent on myself financially. This forgiveness would wipe out my debt (approx. 8K) and give me a cushion I had never anticipated. I live in a big city and it is so hard to save. I’d been putting away my loan repayments while they were paused + the Covid tax rebate and planned to eventually pay down the principal with that. Now I have approximately 5K, not to mention the future monthly payments, that I can now direct into my savings.

I feel like I can take a breath. It’s not a ton, it won’t get me on the property ladder but it gives me just a little space to breathe, maybe even go on a nice vacation. My family is opposed to debt forgivenesses on principle, they say it’s unfair but so much about our system is desperately unfair. My college degree got me a great job but that great job is not enough to get me a house where I live. Not without generational wealth or a partner. The deck is stacked, I’ll take relief where I can.

I took out $19k and now owe $33k. Had a Pell Grant so this $20k reduction helps even the score against predatory interest, and will improve my credit score as well!

I feel like I could actually start thinking about owning property sometime soon or other things I’ve always wanted to do: Take my mom on a vacation all expenses paid, or pay off some of the student loans she still has from my undergrad!

I come from a working class family, went to a liberal arts college on scholarship (with Pell Grants) and graduated with about $40k in public loans. I served in the Peace Corps and had about $8k forgiven. Paid off some, but still have about 30k left.

I now work for the federal government and make a solid middle class income. At 30, having 20k forgiven would be life changing. It would go a very long way in direct contribution to saving for a down payment on a home. Also, the amount of psychological distress these loans have had over the last 9 years is hard to convey. 20K forgiven will help ease my anxiety around finances.

I’m 55, just got laid off, and still have $12k+ student debt from my masters degree in 2006. Getting debt relief means I can put more $ into retirement to avoid the bread line in older age.

I am so relieved. I don’t have much left ($20k), and I have a much higher paying job now, but the $20k lingers in the back of my mind every day as another obstacle to overcome before I feel like I can start my “real” adult life…mind you, I’m 33! I’ve been adulting for a while! But I’m still renting and i would love to buy a house w/my partner without this mental stress!

This is huge for me. Graduated grad school in 2012 and due to loans, have never had any sort of significant savings. A trip to the ER last year saddled me with more debt and now I can finally pay it off. I can’t even imagine how my monthly budget will look now.

I had mine completely forgiven last month under the PSLF program. Here's how it changed my life: When I was at the dentist last week for a routine cleaning, inevitably the subject of my 30 year old bridges came up. I realized that the idea of getting new bridges was FAR less terrifying a prospect because I could finally afford them. The future stress that my anxiety brain creates is gone. I equate it to getting a new car after you’ve been driving a junker for many years. The subconscious stress kicking around in your brain that goes “what will I do if my car breaks down?” is no more.

This will cut my outstanding loan in half. It gives me way more financial confidence in having a second kid, will help us increase our emergency fund, and removes a significant bill each month. I know not everyone is in my position, but I have the funds available to wipe out the remaining $10k and I just feel so grateful and lucky for the opportunity to get out of debt 11 years after grad school.

I’m in the process of buying my first car, and this relief means I will be able to invest in a newer vehicle that will hopefully last me longer & be a little safer as I move to Alaska.

Since not having to pay through the pandemic, I’ve been able to use what I would have been paying to help my aging and unemployed mom pay her bills. This is huge for folks like me. Do I wish I could spend this on something other than elder care? Sure. Am I grateful that I can help someone who falls through the safety net? Very much yes.

This forgiveness will save my family $500 a month. That's moving into a larger apartment, so that our future (much wanted!) baby could have a room. I don't know if people who graduated pre-2008 crash truly understand what it means to not have the family you crave because you got an education.●

Are you ready to join the community? Do you want access to the weekly links and “Just Trust Me?” Do you to be able to comment and be part of the Discord? Well, then:

Subscribing is how you’ll access the heart of Culture Study. There’s those weirdly fun/interesting/generative weekly discussion threads, plus the Culture Study Discord, where there’s dedicated space for the discussion of this piece, plus equally excellent threads for Job-Hunting, Reproductive-Justice-Organizing, Moving is the Worst, No Kids Club, Chaos Parenting, Real and Potential Austen-ites, Gardening and Houseplants, Navigating Friendships, Solo Living, Fat Space, Lifting Heavy Things, and so many others dedicated to specific interests, fixations, obsessions, and identities.

If you’ve never been part of a Discord: I promise it’s much easier and less intimidating than you imagine.

As always, if you are a contingent worker or un- or under-employed, just email and I’ll give you a free subscription, no questions asked. If you’d like to underwrite one of those subscriptions, you can donate one here.

If you’re reading this in your inbox, you can find a shareable version online here. You can follow me on Twitter here, and Instagram here — and you can always reach me at annehelenpetersen@gmail.com.

I don't qualify for any forgiveness, and don't necessarily have a problem paying back what I borrowed, but FFS, at least get rid of the ridiculous interest rates on what I'm paying. Paying back the loans isn't my problem, it's the TOTAL AMOUNT I will have paid after 5% interest compounds over years. It makes me see red.

I think that the changes to Income-Driven Repayment are an even bigger deal (or at least, AS big a deal) as the $10/20k forgiveness, but what I'm puzzled by is that the forgiveness seems to apply to both undergrad and graduate loans, whereas the IDR changes seem to specify that they are ONLY for undergrad loans. Does anyone know what the rationale there is? My only loans are from grad school, but with $10k off the top I'll have a very small amount left to pay, so I'm really not worried about myself here. I *am* really worried about all of the people who got sucked into predatory self-pay Masters programs, though, because I think that's a group that would massively benefit from the changes to IDR but seems to be left out.

(I'm wondering how much of the distinction is based on a sense that grad school is more "optional", and/or a belief that those with grad school experience are likely to be more highly-paid. I don't know the actual numbers here, but I'm guessing someone does! My own experience tells me that people who have grad school loans, especially if they have loans without having been able to finish the degree, are likely to end up in low-paying jobs.)