How Did You Buy Your House? (Or Make Another Big Purchase)

An Exercise in Ownership Transparency

Our conversation a few weeks ago about how we talk (or don’t talk) to friends about money gave me an idea: what if we created a space where those who’ve been able to buy a home (or make any other large purchase) talked VERY SPECIFICALLY about the specific waypoints on the road to ownership….with a goal of demystifying (and de-glamorizing) the process.

In other words, instead of “we were lucky enough to buy a home,” we say “I received $100,000 in inheritance when my dad passed away young which I added to my $10,000 in savings and I was able to buy a condo in a mid-size Midwestern city with a $1200 monthly payment and an HOA of $150 a month, and I was able to get the mortgage because I had just recently rounded the year mark at my first full-time job.”

Maybe you know so much about what it takes to buy a home. Maybe, like me, you knew very little until it actually became a possibility — and were somewhat blindsided by the complexity of the process. Maybe you feel like it doesn’t make sense how so many people you know have homes (especially since they’re not talking about it) or need some reassurance that a whole lot of home ownership is rooted in 1) systemic advantages and 2) luck. It is very rarely about “who works the hardest.”

To be clear, the purpose of this thread isn’t to make people feel “bad” about buying a house. It’s to make the “dream” less dream-like, to clear the haze, to actually have the conversation that we often avoid in the name of social niceties (and preserving existing privileges).

If you’ve been able to buy a home or make another big purchase, tell us how it happened for you, with as much detail as you can.

Some details to consider including:

Very basic purchase stuff: Amount the house cost, when and where you bought, what the real estate market was like at the time

How much you put down and where that money came from (and how long it took to amass) (Did you have to have mortgage insurance because of how low your down payment was? Because I sure did)

Your mortgage payment and what percentage of your income it was/is

Mortgage rates when you bought and how that affected the entire process (and whether you had a “standard” mortgage or not)

Whether you bought with someone else or had a cosigner and how that affected the entire process

What it was like getting mortgage pre-approval — were you flagged for anything? Was it more difficult because you or someone else worked freelance?

Have you ever refinanced? When and for what reason?

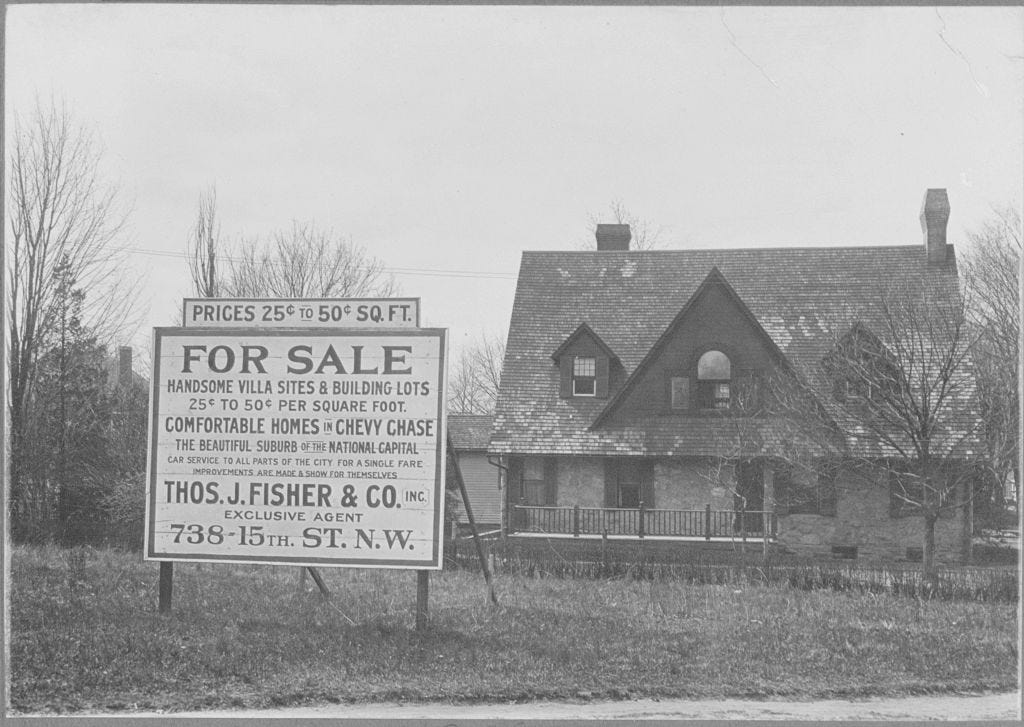

If your family had historical wealth — and I don’t mean, like, a massive fortune…more like the ability to pass down money or property — where did it come from? (“Free” land? GI Bill Mortgage Assistance?)

What payments were you NOT making that made the process easier? (I realize this one’s hard, but it’s a great way to think about ownership is possible). Did/do you have a student loan payment? A large car payment? Paying for your parents’ care or medical costs?

How your race affected where you felt comfortable buying and the number of options available to you (and how race affected your family’s ability to accumulate wealth and property)

How and when did you sell — and how did that allow you to buy ANOTHER property?

I’m sure there are more factors I’m not thinking of here, and I hope you include them, too. If this feels slightly out of your comfort zone, think about why — and consider pushing yourself to do the uncomfortable thing. I’ll share my story in the comments, and really look forward to reading yours as well.

I’m treating the comments as a private, subscriber-only space — one of the only spaces that I trust to be able to pull off this conversation with care and consideration.